If a reduction in income is on the cards and you’re starting to worry about your cash situation, you’re not alone. Here are some pointers to help you prepare.

One million employed Aussie families are expecting a child or have recently had a child, with almost all families taking some form of leave from employment during that time1.

Meanwhile, findings from AMP’s Women, Parental Leave and Financial Stress Report revealed 71% of those expecting a baby were experiencing some level of financial stress2.

According to those surveyed, this was largely due to expecting parents feeling uncertain around what was included in government-funded parental leave policies as well as parental leave policies that were offered by some employers3.

We take a look at what else came out of the report, while providing a few financial tips that could come in handy if you’re feeling a bit overwhelmed by what’s up ahead.

How expecting parents feel financially

Uncertainty around parental leave payments from the government and potentially employers impacted how expecting parents were able to budget for the gap in income while they were on leave4.

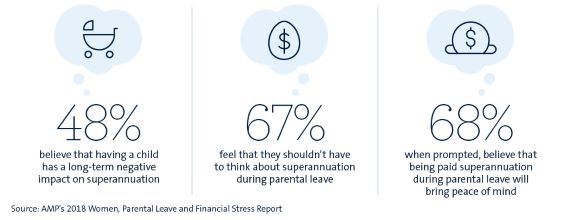

According to the research, one in five primary caregivers took employer-funded leave, but didn’t know the specifics of their benefits, with 68% of those adding that superannuation was the last thing on their mind when having a child5.

Another finding revealed that it could be a particularly stressful time for single-parent families as they were unable to rely on another income source during their time out of the workforce, which emphasised why it was important to try to plan ahead as much as possible6.

Some tips to stay on top of your money situation

Look into potential medical expenses sooner rather than later

Medical costs may include doctor and hospital bills, scans, birthing classes and special medical tests.

Regardless of whether you want to have your baby in a public or private hospital, there may still be out-of-pocket expenses with either option, even if you have Medicare or private health insurance.

Many private health funds also have waiting periods before you can claim on pregnancy and birth-related costs, so this is worth looking into if it’s something you’re thinking about.

Meanwhile, if you want your child to be covered under a health insurance policy, this is worth some investigation, as a single or couple policy may need to be extended to a family policy.

Start making a list of some of the upfront and ongoing costs you’re likely to come across

These might include things like:

-

car seat and stroller

-

cot and mattress

-

change table and high chair

-

baby clothes and nappy bag

-

food, nappies, bottles and formula

-

childcare (which may be worth looking into ahead of your baby’s arrival).

Also consider whether you could go without a few non-essential baby items, whether you can buy things second hand, or if you might be able to get a few items handed down from family or friends.

If you’re planning on having a baby shower, organising a gift registry might also be worthwhile so that your friends and family know what you don’t have but may need, which could help to ensure you don’t end up with multiple same-sized onesies that your baby may only fit into for a little while.

Look at whether you’re eligible for employer-funded incentives early on

Many organisations have their own parental leave policies, which may include various paid and unpaid parental leave entitlements for new mothers and fathers.

Check out whether your employer has such a scheme in place and what they offer. You may also want to find out if you’re eligible for any annual leave, long-service leave or regular unpaid leave if you’re planning to take time off work.

See what government assistance may be available to you

If you meet criteria, primary carers of newborn or adopted children can apply for parental leave payments from the government, which provide the national minimum wage for up to 18 weeks7.

These payments can be received in addition to any payments your employer pays under their own parental leave policy if you happen to be eligible.

You may be entitled to other assistance such as Dad and Partner Pay, which provides up to two weeks of government funded pay, and the Family Tax Benefit, which helps with the cost of raising children8.

There’s also a range of additional payments for families, such as assistance with child care fees that also may help.

Start creating a budget with the information you’ve collected

Once you’ve considered the costs, any entitlements you may be eligible for and how long you may take off work, it’s important to set up a budget and start putting money aside where you can.

When you do this, remember to account for existing day-to-day expenses, such as utility bills, groceries, petrol, insurance, rent or home loan repayments, and other debts you may be paying off.

Remember to also factor in any additional sources of income you could be receiving and whether you have family that may be able to assist in helping you minimise expenses, such as childcare.

Think about whether you have time to pay off any existing debts

If you do have existing debts—credit cards, personal loans or a home loan—it may be a good idea to reduce these debts as much as you can before the baby arrives, particularly as, like with most things, there may be additional unexpected expenses along the way.

Higher interest rates and added fees can also affect what you pay back on top of the principal amount, so consider shopping around to see if you can get a better deal.

You may want to look into whether consolidating your debts into one (if it means you’ll pay less in fees and interest charges) might be a good option for you.

Understand what impact there could be on your superannuation

Superannuation is generally not paid when you’re on parental leave, so you may want to consider whether you’ll make additional contributions while you’re still working.

There are more ways than one to boost your super savings, which you could start doing at any time. And, the good news is, there may be some financial benefits in doing so.

Please contact us on 02 4605 0350if you seek further information on this topic.

1-6 AMP’s 2018 Women, Parental Leave and Financial Stress Report pages 5, 6

7 Department of Human Services – Parental Leave Pay

8 Department of Human Services – Parental Leave Pay – related payments and services

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling 02 4605 0350, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person.